|

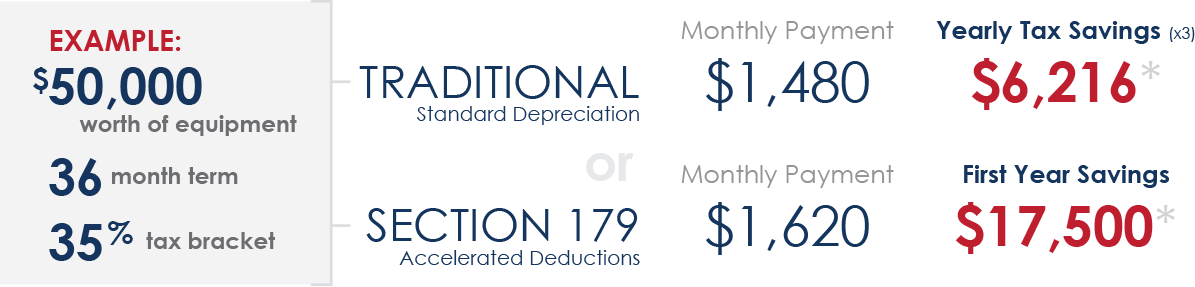

As a small business owner, it's important to take advantage of any tax deductions that can help reduce your tax liability. One such deduction is Section 179 Depreciation. This allows you to deduct the full cost of qualifying equipment purchased or financed during the current tax year. Here is how buying from EM Visual can help you take advantage of the deduction. How Section 179 WorksSection 179 is an IRS tax codes allowing a business to deduct the full cost* of qualifying equipment acquired (and put into use) during that same tax year, rather than using standard depreciation to write off smaller amounts over several years. In 2024, a business can deduct the full purchase price of qualifying equipment up to $1,220,000. There are restrictions that may prevent some businesses from taking Section 179 (e.g. large companies or companies with tax losses).

QualificationsEquipment, machines, vehicles, computers and software, and office furniture for business use could all qualify. Certain types of improvements to your office building may even qualify! RestrictionsHere are a few of the key limitations:

Equipment or assets must be installed and put into use on or before December 31, 2024 to qualify for a deduction this year. Factors like inventory and long lead times make it necessary to start thinking about making your capital equipment purchases and planning for Section 179 deductions now! Contact us today and let us help you save money on your 2024 taxes. |

What you Need to Know about Section 179 for Small Business Owners

Posted by

Electro-Matic on Nov 14, 2023 11:46:45 AM

Topics: Going Green, Electro-Matic Sign News, LED Lighting, News